Stamp Duty Land Tax temporary reduced rates

Matthew Power • July 12, 2020

This weeks announcement that stamp duty is being temporarily reduced with immediate effect is most certainly the best news buyers, sellers and property professionals have had in a long while and represents huge savings especially for transactions below £500,000 where a zero rate applies for first time buyers.

Surrey property development company, Spring Developments acquire land and property for new housing projects across the South East. Our developments aimed mostly at first time buyers and home movers and the immediate reductions in stamp duty have been welcomed by our buyers with many saving as much as £15,000 on the purchase of their Spring Developments new homes.

Since stamp duty increase in 2016, property professional have been campaigning for SDLT to be reduced. Property professionals and second home owners being hit the hardest with higher rates, so like us I am sure many will be taking advantage of the temporary reduced rates on new acquisitions up until the 31st March 2020.

www.gov.uk provides the following information regarding Stamp Duty Land Tax and the temporary reduced rates and can be viewed by flowing this link

Residential Rates on purchases from 8 July 2020 to 31 March 2021

If you purchase a residential property between 8 July 2020 to 31 March 2021, you only start to pay SDLT on the amount that you pay for the property above £500,000. These rates apply

whether you are buying your first home or have owned property before.

You can use the table to work out the SDLT due:

Property or lease premium or transfer value SDLT rate

Up to £500,000 Zero

The next £425,000 (the portion from £500,001 to £925,000) 5%

The next £575,000 (the portion from £925,001 to £1.5 million) 10%

The remaining amount (the portion above £1.5 million) 12%

From 8 July 2020 to 31 March 2021 the special rules for first time buyers are replaced by the reduced rates set out above.

Use the SDLT calculator

to work out how much tax you’ll pay.

Higher rates for additional properties

The 3% higher rate for purchases of additional dwellings applies on top of revised standard rates above for the period 8 July 2020 to 31 March 2021.

The following rates apply:

Property or lease premium or transfer value SDLT rate

Up to £500,000 3%

The next £425,000 (the portion from £500,001 to £925,000) 8%

The next £575,000 (the portion from £925,001 to £1.5 million) 13%

The remaining amount (the portion above £1.5 million)

Refurbishment of this 3 bedroom period home in Peckham SE15 is now complete and this stunning period property is now available for sale. The property had not been refurbished or properly maintained since the 1970's and has been given a new lease of life. Following a successful planning application to rebuild a dilapidated side bay window, alter some openings and make some cosmetic changes and upgrades our main contractors embarked on this thoughtfully planned refurbishment project. The property has been fully refurbished, featuring new double-glazed sash windows, a complete rewire and re-plumb and a new Worcester boiler with Hive smart control. Full fibre broadband connectivity has been installed. The ground floor has new damp-proofing, tanking and insulation throughout. The roof has been overhauled and a Velux window has been installed above the bathroom and a sun tunnel designed to compliment the vaulted ceilings at the rear of the house. On the ground floor, there is a bright and spacious lounge through diner with a bay window to the front. To the rear, the original dining room and kitchen have been combined into one generous space. The original dilapidated bay window has been replaced with a striking welded-glass feature box bay and with the additional bi-folding doors opening directly onto the landscaped garden natural light now floods into the property. The kitchen is a sleek, handleless design with marble quartz worktops and splash backs and has been fitted with Bosch integrated appliances. A new spacious ground-floor WC has been introduced to the property and under the stairs has been used to provide a utility room and additional practical storage. Upstairs, there are three good sized bedrooms and a family bathroom, which has been enlarged to include both a separate shower and a full-sized bath. Externally, the rear of the property has been finished with coloured silicone render, giving a crisp, modern appearance. The garden has been landscaped with new fencing, a patio area and a freshly laid lawn, along with outdoor lighting and a water tap. Every aspect of this property has been carefully considered and executed to a high standard, resulting in a truly turnkey home in one of Peckham's most desirable locations.

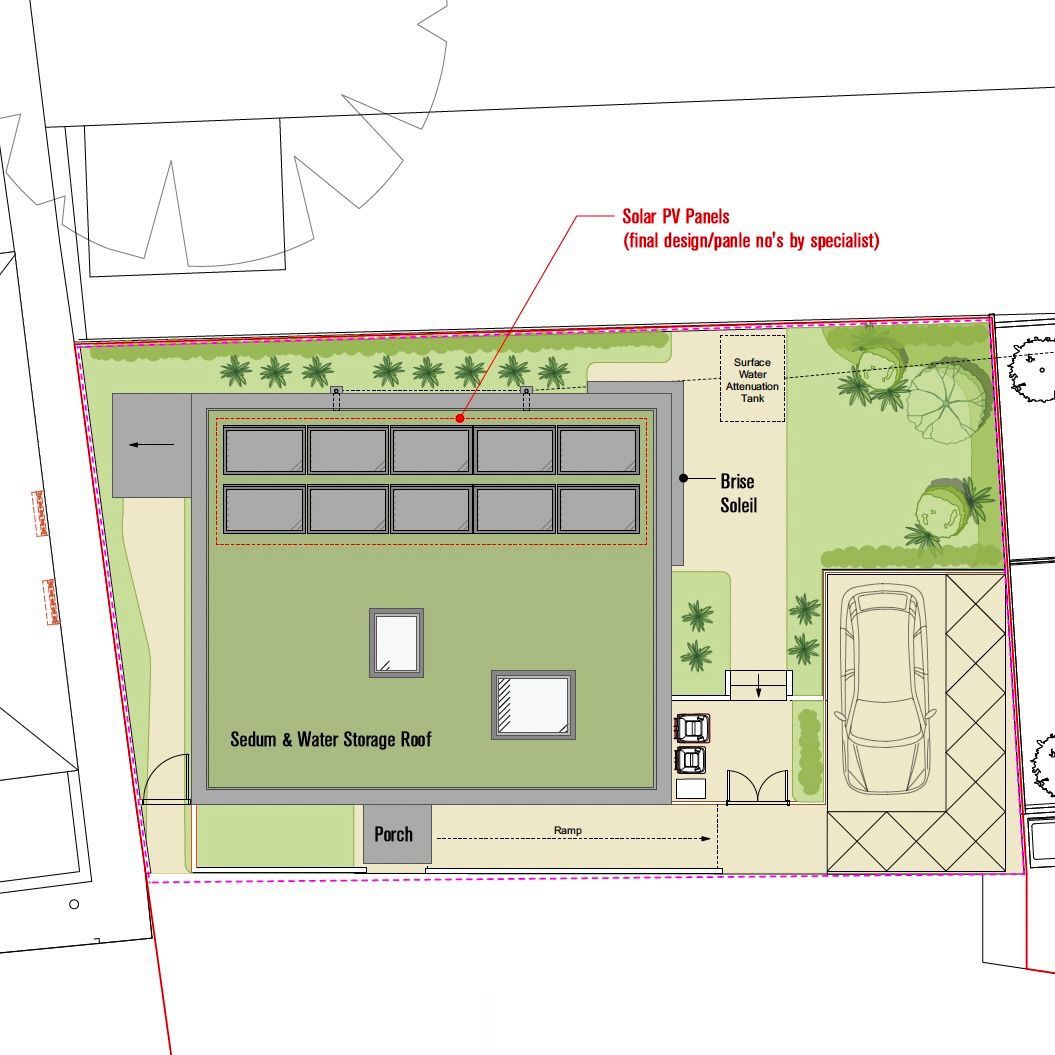

We are pleased with progress at our site in the London Borough of Sutton where the substructure has now been completed and the detached bungalow is starting to take shape. This project has been constructed using SIPs, fabricated off site and assembled onsite over the past 4 weeks. This method of construction provides excellent over all thermal performance with low U values, reduced thermal bridging and excellent air tightness. In addition the property will have air source heat pumps, PV and a Bauder green roof all designed to make the property ultra energy efficient. We are currently working with our Kitchen and bathroom designers and have been working with our architects to improve some of the landscaping design. This detached 2 bedroom bungalow is expected to be completed in December 2024. If you are interested in purchasing this property and would like to find out more please do not hesitate to get in touch. info@spring-developments.com

Spring Developments are pleased to announce that our latest project started this week in the London Borough of Sutton. This development comprises a detached two bedroom bungalow with wrap around gardens and off street parking. The property is conveniently situated within walking distance of Sutton High Street and mainline station and we anticipate the property to be completed by the end of the year. For further information please do not hesitate to get in contact.